Bank Of America Direct Deposit

Transfers require enrollment in the service and must be made from an eligible Bank of America consumer or business deposit account to a domestic bank account or consumer debit card. Recipients have 14 days to enroll to receive money or the transfer will be canceled.

Microsoft Internet Explorer 6.0 is no longer compatible with Online Banking. To ensure maximum security and the best experience, please:

- Go to the Internet Explorer, Firefox or Chrome websites and download a new browser version

- Review Online Banking system requirements, options for access, notices and disclosures

- Once you have finished, you will need to restart your computer and sign back into Online Banking

- Direct deposit transfer can be set up as a one-time transfer or as an automatic recurring transfer. This option can be set up by going online to the Bank of America cardholder website. Do not contact the Nevada Unemployment office to set up a direct deposit transfer.

- CashPay is a Visa® or Mastercard®-branded card account, which allows the company to offer direct deposit to those employees who do not have a checking account or who do not want their pay, deposited into their existing bank account. The deposit account is FDIC-insured and follows all Regulation E requirements.

Online Banking and eCommunications System Requirements

When you first enrolled in Online Banking, you agreed to receive certain Online Banking notices, disclosures and communications ('eCommunications'). Please refer to your Online Banking enrollment documents for a list of these eCommunications. While you may be able to access Online Banking and eCommunications using other hardware and software, your personal computer needs to support the following requirements:

- An operating system, such as:

- Windows NT, 2000, ME, XP, Vista or Win 7; or

- Mac OS 10

- Access to the internet and an internet browser which supports HTML 4.0 and 128bit SSL encryption and Javascript enabled, such as:

- For Windows NT, 2000, ME, XP, Vista, or Win 7

- Microsoft Internet Explorer 7.0 and higher

- Firefox 3 and higher

- Chrome 3.0 and higher

- For Macintosh using OS 10.x

- Safari 3.0 and higher

- Firefox 3 and higher

- Chrome 4.0 and higher

- For Windows NT, 2000, ME, XP, Vista, or Win 7

Most eCommunications provided within Online Banking or at other Bank of America websites are provided either in HTML and/or PDF format. For eCommunications provided in PDF format, Adobe Acrobat Reader 6.0 or later versions is required. A free copy of Adobe Acrobat Reader may be obtained from the Adobe website at www.adobe.com.

In certain circumstances, some eCommunications may be provided by e-mail. You are responsible for providing us with a valid e-mail address to accept delivery of eCommunications.

To print or download eCommunications you must have a printer connected to your computer or sufficient hard-drive space (approximately 1 MB) to store the eCommunications.

Withdrawing Consent to eCommunications and Effect on Online Banking Access

Subject to applicable law, you have the right to withdraw your consent to receiving eCommunications by calling the appropriate toll-free customer service phone numbers listed on the Customer Service tab. You will not be charged a fee for withdrawal of your consent.

If you withdraw your consent, we may stop providing you with eCommunications electronically and we may terminate your Online Banking access. Your withdrawal of consent is effective only after you have communicated your withdrawal to Bank of America by calling the appropriate customer service phone numbers and Bank of America has had a reasonable period of time to act upon your withdrawal. Your consent shall remain in force until withdrawn in the manner provided in this section.

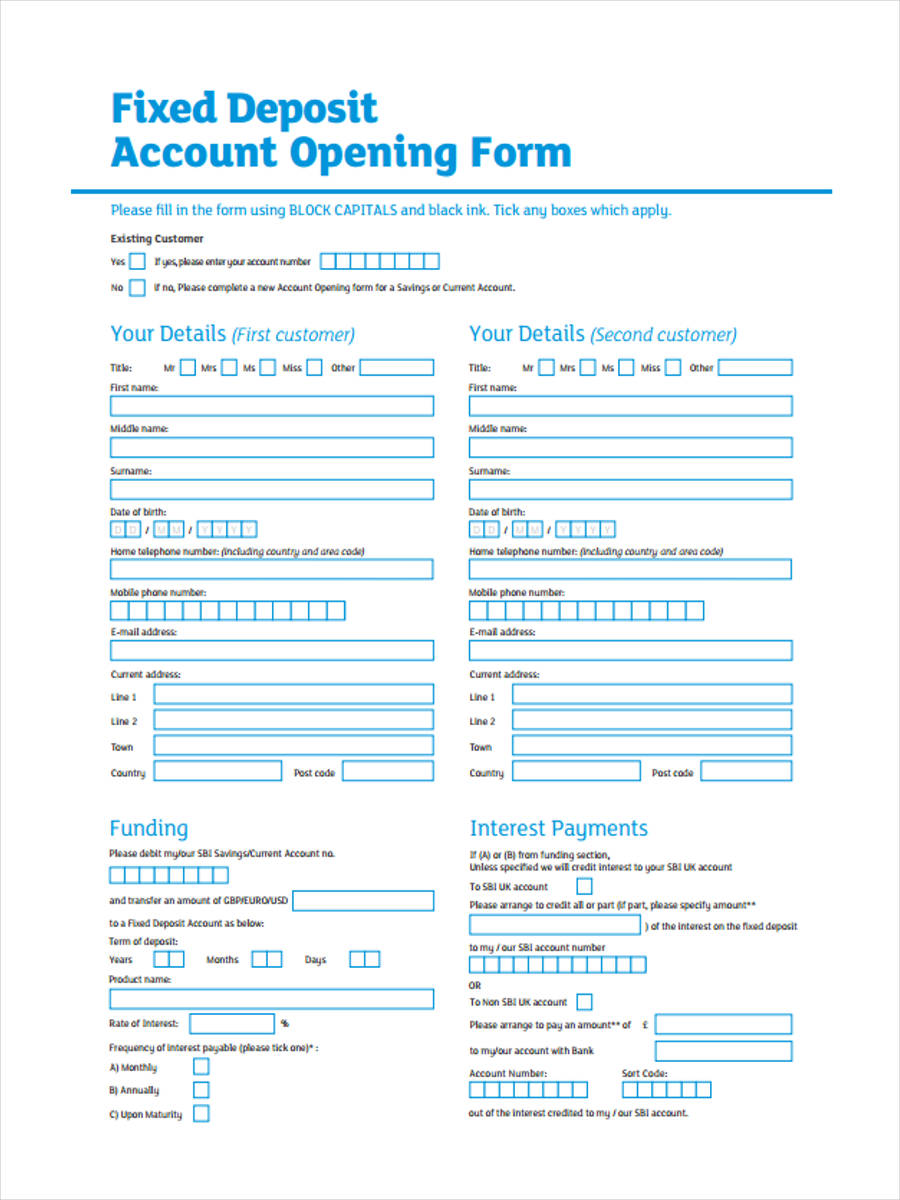

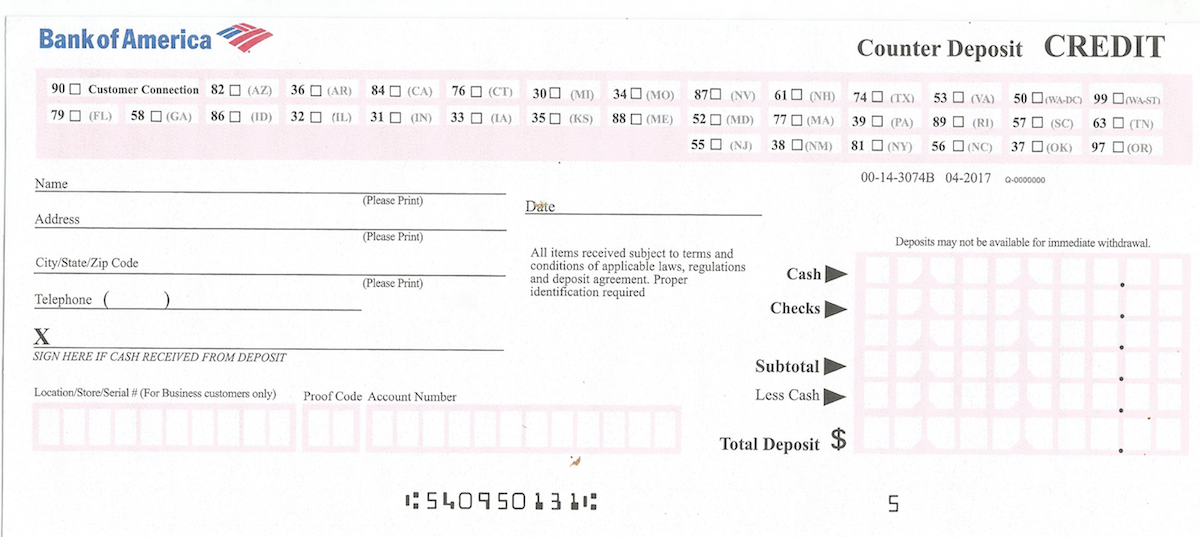

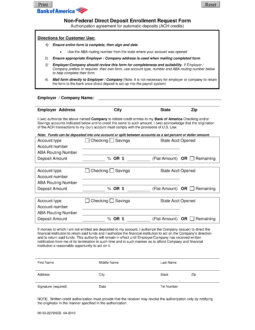

The Bank of America direct deposit form is a legal document used to gather all of the required information needed by an Employer for the purposes of directly paying into an Employee’s Account. This form will allow the ability to set up a Direct Deposit across three Accounts however, it is worth noting, that not every Employer will provide this option. It is very important to clear up such issues with your Employer before submitting this form. Additionally, make sure to submit this form to the appropriate entity in your place of Employment as it will contain some very sensitive information.

- In other languages – Chinese, Korean, Spanish (español), and Vietnamese

Step 1 – Download the Bank of America Direct Deposit form using the PDF button below the image. Read statements 1 through 4 contained within the box at the top of the document

Step 2 – You will need to document several pieces of Employer Information on the first two lines. Next to the words “Employer / Company Name,” enter the Employer or the Name of the Company that shall be depositing your payments directly to your Bank of America Account.

Bank Of America Direct Deposit Faq

Step 3 – On the “Employer Address” line, enter the Street Address, City, State, and Zip Code where your Employer (or Employer Company) is located.

Step 4 – The next section will ask you to define the Account or Accounts where you wish the Direct Deposit to transfer funds to. It will be divided into three boxes which will allow for three Accounts to receive the Direct Deposit being set up. If the deposit arrangement you prefer will involve only one Account, only fill out the first box. To begin, select the applicable account type (Checking or Savings) by marking the appropriate check box then, enter the state in which the account was opened in the right hand corner of this box.

Step 5 – Report your Account Number on the line designated as “Account Number.”

Bank Of America Non Federal Direct Deposit

Step 6 – Enter the ABA Routing Number of the Bank of America Branch that houses your Account on the blank line below your Account Number.

Step 7 – You may now define the Deposit Amount as a Percentage, Dollar Amount, or a Balance (if splitting Account). For instance, if you would like to split your deposits between two accounts, you will need to compliment the two boxes you filled out on this line. Thus, if you have %25 of your payment deposited in one account, you may choose to enter %75 on this line, a set flat Dollar Amount, or simply choose the check box labeled “Remaining.” If you only fill in one box and wish the full Amount of your paycheck deposited into one account, simply fill in one box then report %100 on the Deposit Amount line.

Step 8 – Read the paragraph present below this section. You must agree with this paragraph before Signing and Submitting this form. When you are ready, enter your First name, Middle name, and Last name on the first line. Then enter your Address on the line below your Name. Finally, on the last line of this document you must Sign your Name, enter the Current Date, then, enter your Daytime Telephone Number.

Direct Deposit Form Bofa

Step 9 – Submit this form according to your Employer’s Direct Deposit sign up procedures.