Chime Deposit

Are you familiar with mobile check deposits?

This means you can deposit checks without going to the bank. And, being able to deposit paper checks, such as a stimulus check, without going to the bank can make things super convenient.

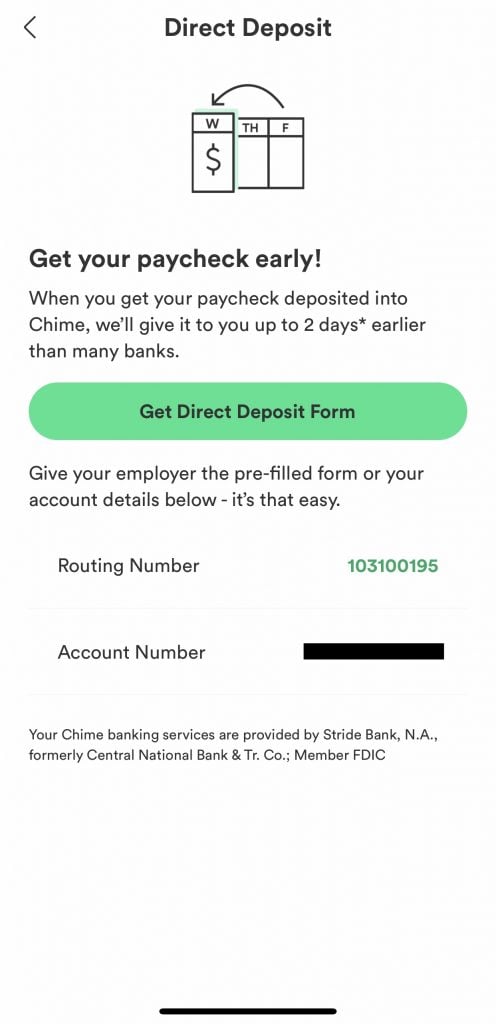

With the early direct deposit feature, your direct deposit will be posted to your Chime Spending Account as soon as it is received from your employer or payer. If you have questions about the timing of your. Unlike other similar platforms like Cash App and Venmo, Chime deposits are FDIC-insured. With its partnerships with The Bancorp Bank and Strike Bank, N.A., Chime accounts have routing and account.

Wondering how to deposit a check this way? If you’ve never used mobile check deposit before, it’s not as difficult as you might think. Take a look at 5 tips that can help you make the most of this feature – saving you valuable time.

1. Check your bank’s mobile check deposit guidelines

The first thing you need to do is make sure the organization you’re banking with is set up for mobile check deposits. The easiest way to do that is to check your mobile banking app.

When you log into mobile banking, head to the menu and look for the mobile check deposit option. If you see it listed, then your app should allow you to deposit checks online.

Before you try to use mobile check deposit, however, make sure your account is enabled to do so. While the feature may be available in mobile banking, you may still have to register first or sign up.

2. Review mobile check deposit limits

If you know that you’re able to deposit a check through mobile banking, the next step is to determine whether there are any limits on deposits.

For example, some financial institutions impose limits on the number of checks you can deposit per day or per week. There may also be daily, weekly or monthly limits on the total dollar amount you can add to your bank account using mobile check deposit.

So, make sure you can deposit your check without going over those limits. For example, say you’re married with two kids and you received a federal stimulus check for $3,400. If your bank’s mobile check deposit limit is $5,000 per day, you should be able to deposit the entire check online.

You can usually find out about limits if you read your bank account’s terms and conditions. You can also check your online banking website and look for a section on frequently asked questions. Sometimes this is a good place to start.

What if your check is outside mobile check deposit limits? In this case, you’ll need to find a work-around for depositing it into your bank account. With online bank accounts, for instance, you may have to deposit the money to a checking account at a brick-and-mortar bank, and then move it into your other account via an ACH transfer.

3. Get your check ready for deposit

Depositing a check online isn’t exactly the same as depositing it at a branch or ATM. But you still have to sign the back of the check for the deposit to be valid. You also should make sure all the information on the front of the check is correct.

Depending on your bank account, you may also have to write something extra on the back to denote that it’s a mobile deposit. For example, you may have to add “for mobile deposit” or “for remote deposit capture” below your signature.

Also, make sure the check is legible. Your mobile device needs to be able to “read” the check via the camera when you’re ready to deposit it.

4. Deposit your check via mobile banking

Now you’re ready to deposit a check online!

The process can be different depending on your particular bank account. But generally, here’s what you need to do:

- Log into your mobile banking app

- Find the mobile check deposit option in the menu

- Select the account you want to deposit the check into (i.e. checking or savings)

- Enter the check amount

- Snap a photo of the check – front and back. It’s important to make sure you get a clear image of both sides of the check. Otherwise, you may have trouble completing a mobile check deposit. If the images come out fuzzy or blurry, clean off your camera lens. And, make sure you take photos in an area with good lighting so your camera can pick up details on your check.

- Once your device records the images of your check, review the deposit details. Make sure that you’ve signed the check, selected the right account, and entered the correct amount.

5. Wait for the check to clear

If you deposit a stimulus check – or any check – online, you may want to use the money right away. But, you’ll need to wait for the check to clear in your bank account first.

You may now wonder how long it takes for mobile check deposits to clear. Well, this depends on your bank account, the amount of check, and the type of check involved. Again, check your bank account terms and conditions or read through the FAQs. This might offer up some clarity on how long your mobile check deposit will take to be fully credited to your account.

In the meantime, don’t throw the check away. Why? Because there may be a hiccup with your mobile check deposit. If you don’t see the deposit in your account within a week, you may need to call your financial institution to find out what’s happening. You may also need to try making the deposit again.

Once your mobile check deposit clears your bank account, you can then write ‘void’ on the check and file it away.

How to deposit IRS checks with Mobile Check Deposit using Chime

If you are a Chime member and received a government stimulus payment as a paper check, you can deposit it safely and securely at Chime. We take our members’ money seriously, so for these checks, we’re putting extra security measures in place. Here’s how to deposit your IRS checks using our Mobile Check Deposit feature.

1.Make sure the name on the check matches your Chime Spending Account

2. For joint stimulus checks, make sure at least one filer’s name matches the name associated with the Chime Account. Unfortunately, we can’t accept checks that don’t have your name on it

3. Sign the back of your paper check, then write “For deposit to Chime only” under your signature.

For joint stimulus check make sure both of your signatures appear on the back of the check.

4. Open the Chime app, tap Move Money at the bottom of your screen, then tap Mobile Check Deposit, then U.S. Treasury.

Keep in mind: Mobile Check Deposit for stimulus checks is only available to members that actively use their Chime Spending Account and Chime Visa® Debit Card

5. The Chime app will guide you through the check deposit process – it’s easy!

Chime Deposit Fee

Are you using a mobile banking app for check deposit yet?

Signing up for direct deposit can save you time, but mobile check deposit comes in super handy if you receive a paper check, like a tax refund or stimulus check.

So, if you aren’t taking advantage of mobile check deposit yet, consider signing up. You’ll soon learn just how convenient it is!

Banking made awesome

Welcome to better online banking through Chime. No hidden fees¹. Get paid up to 2 days early with direct deposit.² Grow your savings, automatically. Experience the ease and simplicity of online banking.

Learn how we collect and use your information by visiting our Privacy Policy›

The Bancorp Bank or Stride Bank, N.A.; Members FDIC

Finally, a banking app built by a tech company

- Track your account balances, daily transactions, and savings from anywhere with the Chime mobile app.

- Turn on balance notifications and instant transaction alerts any time you use your Chime Visa® Debit Card.

- Send money instantly to friends using Pay Friends on our mobile banking app.

An Award-winning Mobile Banking App

Chime’s mobile banking app enables you to manage all of your online banking on the go. With over 135,000+ five star reviews in app stores, our mobile app has everything you need with a simple, intuitive design.

Get Paid Up to 2 Days Early with Direct Deposit²

Tired of waiting for your direct deposit? Open a Chime Spending Account, set up Direct Deposit and you’re automatically eligible to receive your paycheck up to two days early.²

Stop waiting and start getting paid early with direct deposit²

- Get a notification as soon as your direct deposit is posted into your Spending Account.

- Never worry about paychecks getting lost in the mail.

- No more waiting for your money while it sits in mysterious electronic limbo.

- Have up to 2 more days to get ahead of your bills.

No Hidden Fees¹

Hidden fees are sneaky. We are not. That’s why Chime offers online banking with no monthly fees or open deposit required. Apply is free for our online bank account. There’s no opening deposit or minimum balance required, no international transaction fees, and if you lose your debit card, the new ones on us.

Say goodbye to unnecessary bank fees

- No monthly fees. No deposit required.

- No minimum balance requirements.

- No foreign transaction fees.

- 38,000+ fee-free MoneyPass® and Visa® Plus Alliance ATMs.

Grow Your Savings Automatically

Saving money has never been so simple. We provide automation tools that help you grow your savings without thinking about it. Chime’s Automatic Savings is an optional Savings Account with several features that allow you to automate your savings plan and achieve your goals faster.

Save money while you spend. Save when you get paid

- Save When You Spend: We round up every Chime Visa® Debit Card transaction to the nearest dollar and transfer the Round Up from your Spending Account to your Savings Account.

- Save When You Get Paid: Automatically transfer 10% of every paycheck $500 or more directly into your Savings Account when you set up Direct Deposit.

Banking Security and Control

At Chime, information security is a top priority. Deposits are FDIC insured up to $250,000 through The Bancorp Bank or Stride Bank, N.A., Members FDIC. And we work hard to protect your information, such as by using encryption and other measures to help safeguard your money and data.

Your money is safe with Chime

- Deposits are FDIC insured up to $250,000 through The Bancorp Bank or Stride Bank N.A.; Members FDIC.

- Shop worry-free at millions of merchants. Chime debit cards are protected by the Visa Zero Liability** Policy to ensure that cardholders will not be responsible for unauthorized charges.

- We support two-factor authentication and support fingerprint authentication.

Chime Deposit Atm

2 minutes with no impact to your credit score.

Chime Deposit Limit

How to Open a Bank Account Online

through Chime

To open a bank account online, there are a few basic requirements. Here are three things you’ll need to start opening your account:

- Social Security number

- Valid home address

- 18+ U.S. Citizen or resident of 50 United States

How do I open a mobile and online banking account through Chime?

Skip the branches, lines, and paperwork that some more traditional banks require to open a checking account and apply for a new bank account online. Chime makes the process of opening a bank account online easy. Here’s how to get started:

- Visit member.chime.com/enroll/ and enter your personal info and complete the enrollment form. Opening an online banking account with Chime takes less than 2 minutes.

- Once enrollment is completed*, we’ll send a Chime Visa® Debit Card in the mail to the address you provided. Your new debit card typically arrives in 7-10 business days.

- Download our mobile banking app, and log in. You can connect your existing bank account to transfer funds or set up direct deposit You can also login to online banking at chime.com when you need it.

Does opening bank account through Chime require a deposit?

Applying for a Chime Spending Account online is free with no opening deposit required.

Is a credit check required to open an account online?

Chime requires no credit check to open an account and provides online banking services that are inclusive of all Americans. This includes those who struggle with bad credit history but are still looking for checking or savings accounts they can open online with no opening deposit. Chime offers a Spending Account that provides a second chance to rebuild your financial health because it doesn’t rely on consumer credit reporting agencies like ChexSystems. See how Chime compares to other second chance bank accounts

2 minutes with no impact to your credit score.

Learn how we collect and use your information by visiting our Privacy Policy›