Chime Mobile Check Deposit Time

What follows is our guide to how long it takes for a mobile check deposit to register in your Chime account. A Direct Deposit is the fastest situation in which a mobile check will clear. The money will move over instantaneously. Bank transfers through the Chime app or website can take up to five business days.

Your federal tax refund is important, and we want you to have it as fast as possible. That's why you can get your tax refund up to 3 days early1 when you direct deposit with Chime and file directly with the IRS.

in government payments have been processed by Chime to date.

- 18 minutes ago Chime direct deposit late. Chime for me has consistently posted shortly right after 10 PM on Wednesdays, albeit tonight posted around 10:57. Chime members with total monthly qualifying direct deposits of 0 or more are eligible to enroll. PayPal is always slower than chime but generally sometime after midnight it shows up.

- Chime offers mobile and online banking through its banking partners with no hidden fees‡. Overdraft up to $100. with no fees, get paid up to 2 days early with direct deposit^, and grow your savings instantly with purchase round ups and an optional High Yield Savings Account (get up to 0.50% Annual Percentage Yield‣ ). Save, spend, and manage your finances with the highly rated Chime mobile.

that filed with the IRS have received their government refunds up to 3 days early1 through direct deposit with Chime.

Filing your taxes can be complicated.

Getting your federal tax refund early1

with Chime is simple!

The IRS will start processing returns on February 12, 2021. Here’s how to help your federal tax refund arrive as quickly as possible with direct deposit.

You may receive forms from your employer or financial institution.

Add your Chime Spending Account and bank routing number when you file your federal taxes directly with the IRS.

Your federal tax refund will post to your Chime Spending Account as soon as it is received.

New to Chime?

Get your federal tax refund up to 3 days early1, access to Chime’s best features, and financial peace of mind by signing up! The process is fast and easy.

We’re going above and beyond to have your back

We can’t control how the IRS processes taxes, but we’re here to help you figure it out and get your refund as fast as possible. Check out our resources on this page for more.

FAQs

If you have questions regarding taxes and your Chime account, please check out our FAQs below

Chime & Taxes

Nope! You do not have to pay or declare taxes for using Credit Builder. To learn more about filing taxes, we recommend speaking with a tax professional and checking theIRS website.

Will I have to pay taxes on SpotMe? Stimulus advances?

Nope! You do not have to pay or declare taxes for using SpotMe or any of the SpotMe Stimulus Payment advances. To learn more about filing taxes, we recommend speaking with a tax professional and checking theIRS website.

I just got my refund! What are my spending/withdrawal limits?

You can find your current Chime Spending Account and withdrawal limits by using the chat feature in your Chime mobile app, or by going to Settings > Account Policies & Terms > Deposit Account Agreement in order to view your current account limits.

Can I still get my refund if my transactions are turned off?

Yes! Disabling transactions only works for Chime Visa® Debit Card transactions and does not affect tax refunds³ or direct deposits.

Can I deposit my refund check with Mobile Check Deposit?

Sometimes. Unfortunately, we cannot currently guarantee that our Mobile Check Deposit feature will accept all tax refund checks³ due to their unique shape, color, and markings.

Learn more about Mobile Check Deposit limits in your Deposit Account Agreementhere. Please view the back of your debit card to identify your issuing bank.

How do I deposit my tax refund to my Chime account?

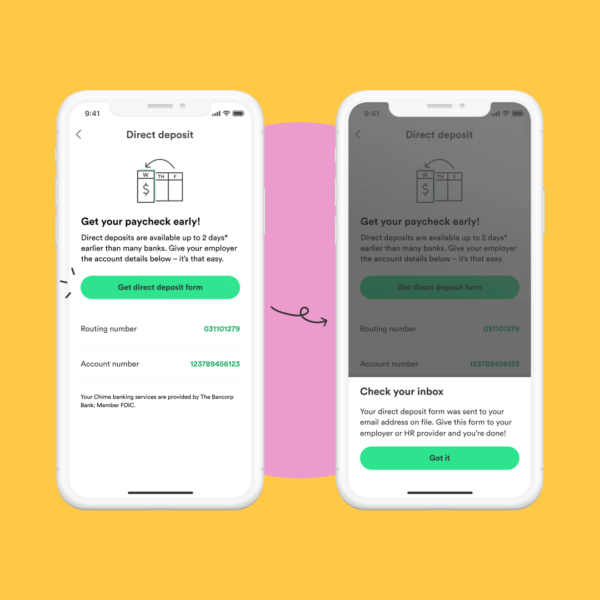

Direct deposit is the easiest way to deposit your tax refund into your Chime Spending Account. Whether you file online or on paper, all you need to do is enter your Chime Spending Account Number and Routing Number where prompted.

You can find your Spending Account Number and Routing Number in the Chime app! Just go to Settings > Account Information!

Will I get my tax refund up to two (2) days early?

We can’t guarantee that your tax refund will deposit earlier than the estimated date provided by the IRS. That said, we’ll always post your tax refund to your account as soon as we receive it!

Yes, however a tax refund may only be direct deposited into an account that is in your name. To accept a joint refund, just make sure the name of the primary filer listed on your tax refund is the exact same name listed on the Chime Spending Account you are depositing to.

Important: If the primary filers name doesn’t match the name on the Chime Spending Account it is being deposited, the deposit will be rejected and returned to the IRS. No more than three electronic refunds can be deposited into a single financial account or prepaid card. If you exceed this limit, you will receive a notice from the IRS and a paper check refund.

If you recently got married or changed your name, contact Chime Member Services to update the name on your Chime Spending Account to match the name on your tax return. You’ll need your updated ID and marriage certificate for verification.

We’ll always post your tax refund to your account as soon as we receive it. If you don’t see your tax refund yet, that means we haven’t received it, and our Member Services team won’t have any further information about when it will become available.

The best way to find your estimated refund date is to visit Where’s My Refund on the IRS.gov website or the IRS2Go mobile app. If your expected refund date has passed, we recommend contacting the IRS for more information.

Chime Mobile Check Deposit Time

Note: State and Federal Tax Returns are processed on different timelines, and may post to your account on different days.

Can you increase my spending and withdrawal limits?

No. Our spending and withdrawal limits are controlled by our holding bank and cannot be changed at this time.

If I lost my card, will I still get my tax refund?

Yes! Your tax return is deposited using your Chime Spending Account number and Routing number. These do not change when you order a new card.

To make purchases larger than your daily spending limit on your Chime Visa® Debit Card, you can set up direct debit payments with billers who offer this option. You’ll just need to provide the merchant with your Spending Account Number and Routing Number.

Direct debits will be removed from your Chime Spending Account when requested by a biller and do not place any hold on your funds. If your balance is not sufficient to cover the payment, it will be declined.

Note: There are no limits or fees associated with direct debits.

Tax Basics

What if I owe money on my taxes this year due to Unemployment?

It’s possible your tax implications may have changed due to COVID and Unemployment. We recommend speaking with a tax professional and checking theIRS website for more information.

/https%3A%2F%2Fspecials-images.forbesimg.com%2Fimageserve%2F5dd208502c886a0007ec5ac0%2F0x0.jpg)

Will I have to pay taxes on the Stimulus Payments?

The IRS has statedthat the Economic Impact Payment (aka Stimulus Payment) will not reduce your refund or increase the amount you owe when you file your 2020 Federal income tax return. For the most updated Tax information, please check theIRS website.

What if I still haven’t received my Economic Impact Payment?

If you did not receive a Stimulus Payment for which you are eligible, you may be eligible for the Recovery Rebate Credit. Please check theIRS website for more information.

What if I need to file for a tax deadline extension?

According to the IRS, if you need more time to prepare and file your taxes, you may be able to file for an extension before the April 15th deadline. We recommend speaking with a tax professional and checking theIRS website for more information.

Alternative: Need more time to prepare your federal tax return? Please check this IRSwebsite which provides information on how to apply for an extension of time to file.

The last day to file your taxes without a penalty is Thursday, April 15th, 2021. To learn more about filing taxes, we recommend speaking with a tax professional and checking theIRS website.

Why should I select direct deposit as my refund method?

Eight out of ten taxpayers get their refunds by using Direct Deposit. It is simple, safe and secure. This is the same electronic transfer system used to deposit nearly 98 percent of all Social Security and Veterans Affairs benefits into millions of accounts.

According to the Internal Revenue Service (IRS), “Combining direct deposit with IRS e-File is the fastest way to receive your refund. IRS issues more than9 out of 10 refunds in less than 21 days. You can track your refund using the IRS’s ‘Where’s My Refund‘* tool.” To find out more, readthis article updated on December 4, 2020.

We will notify you as soon as we have received your refund – with an email and a push notification (if enabled on your mobile device)!

What happens if I made a mistake while filing my taxes?

If your tax refund has not yet been sent, you can call the IRS to stop it. Their toll-free number is 1-800-829-1040.

My refund is less than it should be. What should I do?

If your tax refund is less than you were expecting, we recommend contacting the IRS. If you have the Save When I Get Paid feature enabled, 10% of your tax refund will be deposited automatically into your Chime Savings Account.

Your tax refund may be returned if:

- You filed your tax refund under a different name than the one you have on your Chime Spending Account.

- You attempted to deposit someone else’s tax refund into your Chime Account.

- You accidentally used the wrong account number or routing number when you filed.

The most common reason that tax refunds and direct deposits are returned is because the name on the direct deposit doesnotmatch the name on the Chime Account.

If you recently got married or changed your name, contact Chime Member Services to update the name on your Chime Spending Account to match the name on your tax return. You’ll need your updated ID and marriage certificate for verification.

If the name on the direct deposit does not match the name on the Chime Account, the deposit will be returned to the IRS.

If my tax refund was returned, how do I get it now?

Any tax refund that is returned to the IRS will be sent out as a physical check to the address you listed when you filed your taxes. Please reach out to the IRS directly if your refund was returned.

Are you familiar with mobile check deposits?

This means you can deposit checks without going to the bank. And, being able to deposit paper checks, such as a stimulus check, without going to the bank can make things super convenient.

Wondering how to deposit a check this way? If you’ve never used mobile check deposit before, it’s not as difficult as you might think. Take a look at 5 tips that can help you make the most of this feature – saving you valuable time.

1. Check your bank’s mobile check deposit guidelines

The first thing you need to do is make sure the organization you’re banking with is set up for mobile check deposits. The easiest way to do that is to check your mobile banking app.

When you log into mobile banking, head to the menu and look for the mobile check deposit option. If you see it listed, then your app should allow you to deposit checks online.

Before you try to use mobile check deposit, however, make sure your account is enabled to do so. While the feature may be available in mobile banking, you may still have to register first or sign up.

2. Review mobile check deposit limits

If you know that you’re able to deposit a check through mobile banking, the next step is to determine whether there are any limits on deposits.

For example, some financial institutions impose limits on the number of checks you can deposit per day or per week. There may also be daily, weekly or monthly limits on the total dollar amount you can add to your bank account using mobile check deposit.

So, make sure you can deposit your check without going over those limits. For example, say you’re married with two kids and you received a federal stimulus check for $3,400. If your bank’s mobile check deposit limit is $5,000 per day, you should be able to deposit the entire check online.

You can usually find out about limits if you read your bank account’s terms and conditions. You can also check your online banking website and look for a section on frequently asked questions. Sometimes this is a good place to start.

What if your check is outside mobile check deposit limits? In this case, you’ll need to find a work-around for depositing it into your bank account. With online bank accounts, for instance, you may have to deposit the money to a checking account at a brick-and-mortar bank, and then move it into your other account via an ACH transfer.

3. Get your check ready for deposit

Depositing a check online isn’t exactly the same as depositing it at a branch or ATM. But you still have to sign the back of the check for the deposit to be valid. You also should make sure all the information on the front of the check is correct.

Depending on your bank account, you may also have to write something extra on the back to denote that it’s a mobile deposit. For example, you may have to add “for mobile deposit” or “for remote deposit capture” below your signature.

Also, make sure the check is legible. Your mobile device needs to be able to “read” the check via the camera when you’re ready to deposit it.

4. Deposit your check via mobile banking

Now you’re ready to deposit a check online!

The process can be different depending on your particular bank account. But generally, here’s what you need to do:

- Log into your mobile banking app

- Find the mobile check deposit option in the menu

- Select the account you want to deposit the check into (i.e. checking or savings)

- Enter the check amount

- Snap a photo of the check – front and back. It’s important to make sure you get a clear image of both sides of the check. Otherwise, you may have trouble completing a mobile check deposit. If the images come out fuzzy or blurry, clean off your camera lens. And, make sure you take photos in an area with good lighting so your camera can pick up details on your check.

- Once your device records the images of your check, review the deposit details. Make sure that you’ve signed the check, selected the right account, and entered the correct amount.

5. Wait for the check to clear

If you deposit a stimulus check – or any check – online, you may want to use the money right away. But, you’ll need to wait for the check to clear in your bank account first.

You may now wonder how long it takes for mobile check deposits to clear. Well, this depends on your bank account, the amount of check, and the type of check involved. Again, check your bank account terms and conditions or read through the FAQs. This might offer up some clarity on how long your mobile check deposit will take to be fully credited to your account.

In the meantime, don’t throw the check away. Why? Because there may be a hiccup with your mobile check deposit. If you don’t see the deposit in your account within a week, you may need to call your financial institution to find out what’s happening. You may also need to try making the deposit again.

Once your mobile check deposit clears your bank account, you can then write ‘void’ on the check and file it away.

How to deposit IRS checks with Mobile Check Deposit using Chime

If you are a Chime member and received a government stimulus payment as a paper check, you can deposit it safely and securely at Chime. We take our members’ money seriously, so for these checks, we’re putting extra security measures in place. Here’s how to deposit your IRS checks using our Mobile Check Deposit feature.

1.Make sure the name on the check matches your Chime Spending Account

2. For joint stimulus checks, make sure at least one filer’s name matches the name associated with the Chime Account. Unfortunately, we can’t accept checks that don’t have your name on it

3. Sign the back of your paper check, then write “For deposit to Chime only” under your signature.

For joint stimulus check make sure both of your signatures appear on the back of the check.

4. Open the Chime app, tap Move Money at the bottom of your screen, then tap Mobile Check Deposit, then U.S. Treasury.

Chime Bank Deposit Paper Check

Keep in mind: Mobile Check Deposit for stimulus checks is only available to members that actively use their Chime Spending Account and Chime Visa® Debit Card

5. The Chime app will guide you through the check deposit process – it’s easy!

Are you using a mobile banking app for check deposit yet?

How Long Does It Take For Chime Mobile Check Deposit

Signing up for direct deposit can save you time, but mobile check deposit comes in super handy if you receive a paper check, like a tax refund or stimulus check.

Chime Mobile Check Deposit Cutoff Time

So, if you aren’t taking advantage of mobile check deposit yet, consider signing up. You’ll soon learn just how convenient it is!